All Categories

Featured

Table of Contents

[/image][=video]

[/video]

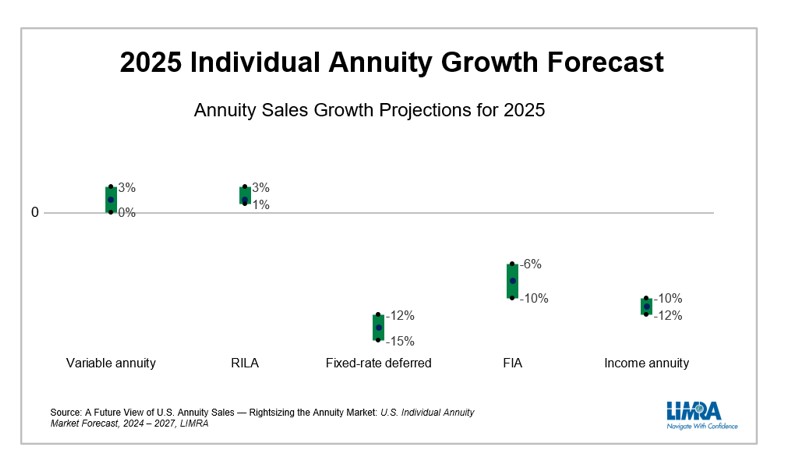

The landscape is changing. As interest prices decline, taken care of annuities might lose some charm, while items such as fixed-index annuities and RILAs gain traction. If you remain in the marketplace for an annuity in 2025, store very carefully, contrast options from the very best annuity firms and prioritize simpleness and transparency to find the ideal suitable for you.

When picking an annuity, monetary strength rankings matter, yet they do not tell the whole tale. Below's how contrast based upon their rankings: A.M. Finest: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Best: A+ Fitch: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A.M. Finest: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A greater economic ranking or it just shows an insurance company's financial stamina.

If you focus just on scores, you could The ideal annuity isn't simply concerning business ratingsit's around. That's why comparing real annuity is extra important than just looking at economic strength ratings.

We have years of experience assisting individuals find the ideal products for their demands. And because we're not associated with any business, we can give you objective recommendations regarding which annuities or insurance coverage policies are best for you.

We'll aid you arrange with all the alternatives and make the ideal choice for your circumstance.

, there are several alternatives out there. And with so lots of selections, recognizing which is ideal for you can be challenging. Go with a highly-rated company with a solid credibility.

Security Benefit Annuity Review

Pick an annuity that is very easy to understand and has no tricks.

Some SPIAs supply emergency liquidity includes that we like.

There are a couple of essential elements when browsing for the best annuity. Contrast rate of interest rates. A higher rate of interest rate will offer even more growth capacity for your financial investment.

This can quickly boost your investment, but it is important to comprehend the terms and problems affixed to the incentive before investing. Believe about whether you desire a lifetime earnings stream. This sort of annuity can give assurance in retirement, however it is important to make certain that the earnings stream will certainly be appropriate to cover your demands.

These annuities pay a fixed regular monthly amount for as long as you live. And also if the annuity runs out of money, the monthly payments will continue coming from the insurance coverage business. That implies you can rest simple recognizing you'll constantly have a consistent revenue stream, no matter how much time you live.

Integrity Annuity Customer Service

While there are numerous different kinds of annuities, the most effective annuity for lasting care expenses is one that will pay for most, otherwise all, of the costs. There are a few things to consider when selecting an annuity, such as the size of the agreement and the payout alternatives.

When selecting a fixed index annuity, compare the readily available items to discover one that finest matches your needs. Enjoy a lifetime revenue you and your spouse can not outlast, supplying financial protection throughout retirement.

Venerable Annuity Ratings

In enhancement, they allow up to 10% of your account value to be taken out without a fine on most of their item offerings, which is more than what most other insurer permit. One more consider our suggestion is that they will permit seniors as much as and including age 85, which is additionally greater than what a few other business permit.

The finest annuity for retired life will certainly depend on your specific requirements and objectives. A suitable annuity will provide a steady stream of revenue that you can rely on in retirement.

How To Get Out Of An Annuity Fund

They are and constantly use some of the greatest payouts on their retirement revenue annuities. While prices fluctuate throughout the year, Fidelity and Warranty are generally near the leading and maintain their retirement earnings competitive with the other retired life revenue annuities in the market.

These scores give consumers an idea of an insurance coverage company's monetary security and how likely it is to pay out on cases. It's important to note that these rankings do not always mirror the quality of the items supplied by an insurance firm. An "A+"-rated insurance policy business could offer products with little to no growth capacity or a lower income for life.

Your retired life savings are most likely to be one of the most essential financial investments you will certainly ever make. If the insurance coverage business can't achieve an A- or better ranking, you must not "wager" on its proficiency lasting. Do you desire to bet money on them?

Latest Posts

Principal Variable Annuity

Variable Annuity Hedge

Annuities With Long Term Care Riders